pay utah property tax online

Search Clay County property tax records or pay property taxes online. Application for Residential Exemption or Request a paper application via.

Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

. If the veteran dies in the line of duty surviving spouse or minor orphan is entitled to property tax exemption of 100 of value of property. Find case details filing date state parties lien status lien amount and much more. This exemption is limited to primary residence or tangible personal property that is held for personal use and not used in a trade or business.

Search millions of property tax liens with Infotracers powerful court search tool. If you do not have and are not required to have a Utah Sales and Use Tax License you must report the use tax on your personal Utah Individual Income Tax Return or Utah business income tax return Form TC-41 TC-65 TC-20 TC-20S or TC-20MC. In some cases the property may be auctioned off to pay the contractor.

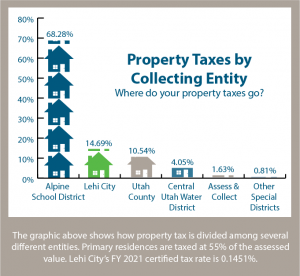

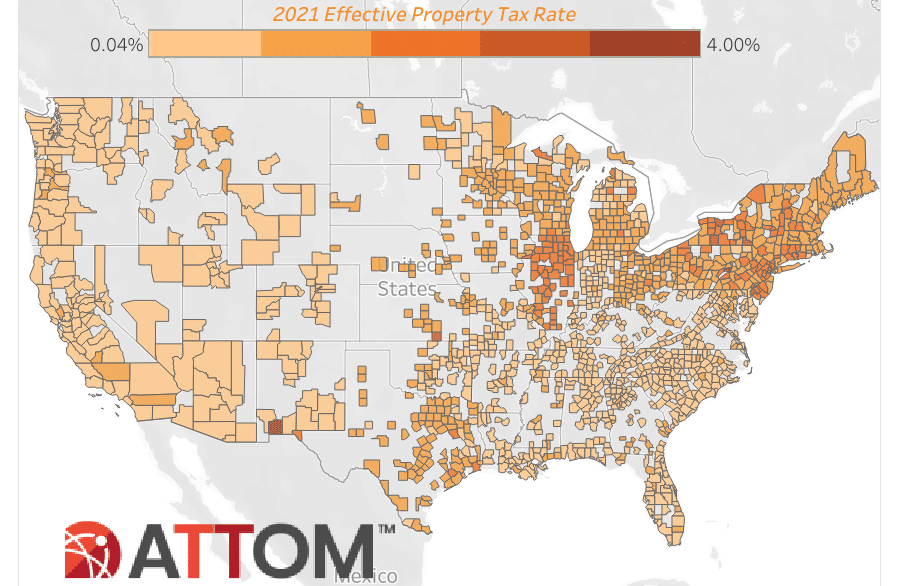

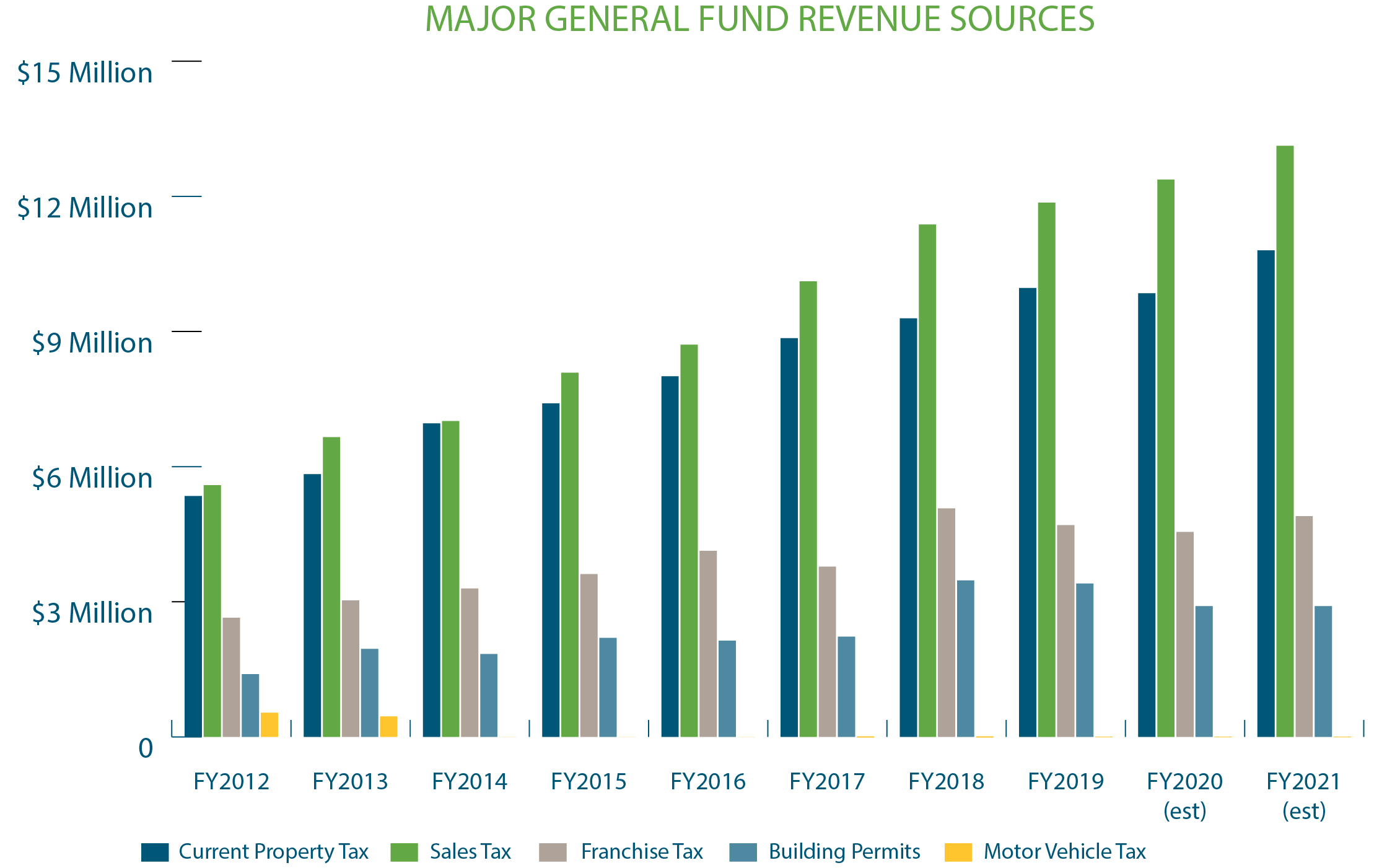

Send a Message Call. The average effective property tax rate in Utah is the 11th-lowest in the country. Overall taxpayers in Utah face a relatively low state and.

435 634-5703 If a property owner or a property owners spouse claims a residential exemption under Utah Code Ann. A tax lien may be placed on property and assets by a government tax authority when. Enter your financial details to calculate your taxes.

Assessor Clay County Assessor Clay County Courthouse 609 East National Ave Room 118 Brazil IN 47834 Phone 812448-9013 Fax 812442-9600. No exemption is allowed for any disability below 10. Homeowners in Utah also pay exceptionally low property taxes with an average effective rate of just 058.

See administrative rule R865-21U-6. 59-2-1035 for property in this state that is the primary residence of the property owner or the property owners spouse that claim of a. THE KANE COUNTY TREASURERS OFFICE IS RESPONSIBLE FOR COLLECTING TAXES Payments for current and delinquent taxes taxes owed for years 2021 and previous can be paid by following the Payments online link below.

Pre-payments for 2022 taxes can be made by mailing a check for the desired amount to our office please include account number or TAKE.

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Purchasing A Home Is More Than Just The Initial Downpayment Between Utilities A Downpa Anzahlung Erstes Eigenheim Initialen

What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

How Affordable Is The New Home Premium Eye On Housing New Homes 30 Year Mortgage Income Tax Saving

How Long Does A Home Inspection Take Gary Buys Houses Home Inspection Selling Strategies Home Buying

Orange County Ca Property Tax Calculator Smartasset

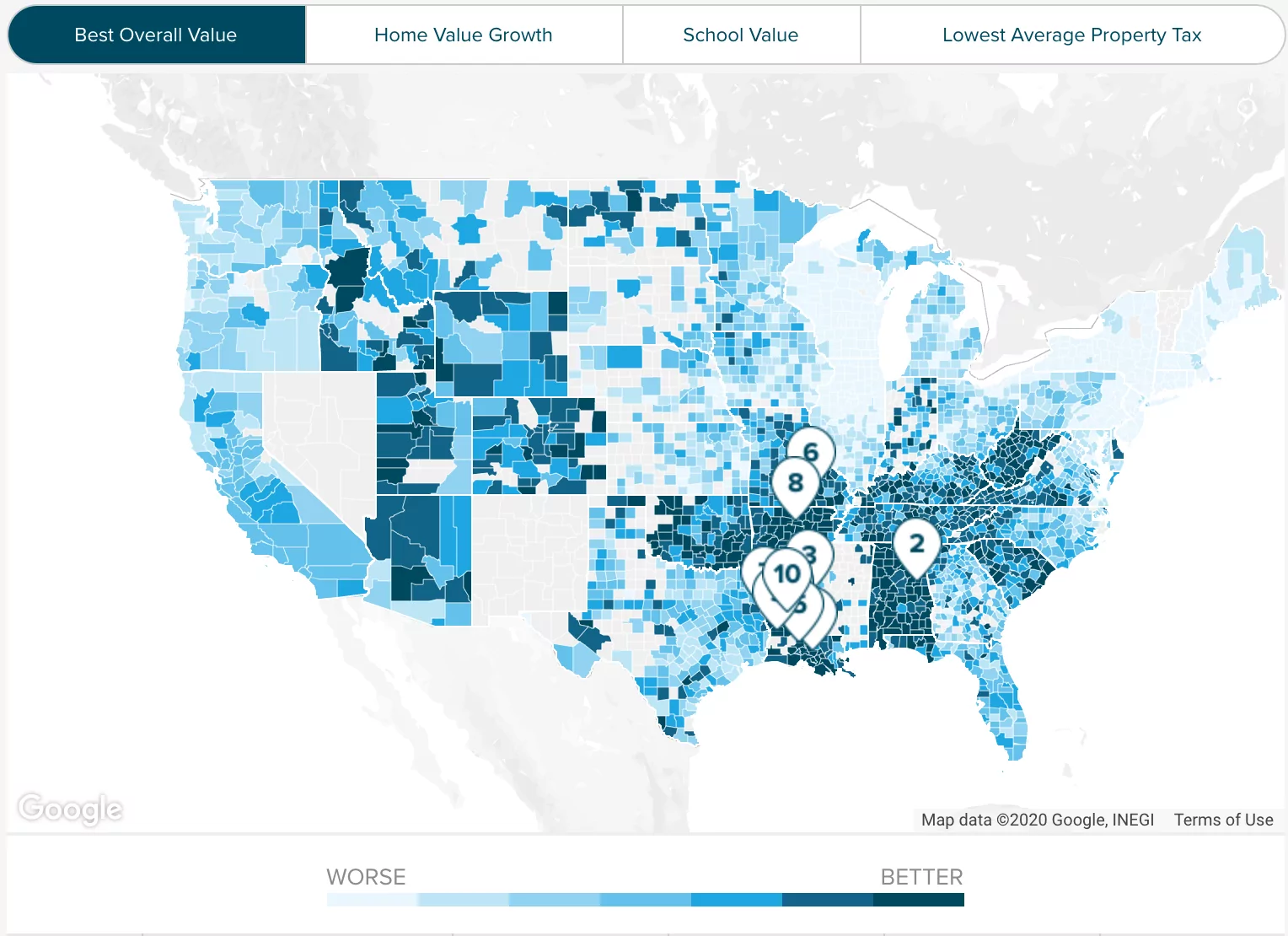

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Purchasing A Home Is More Than Just The Initial Downpayment Between Utilities A Downpa Anzahlung Erstes Eigenheim Initialen

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

Thinking About Moving These States Have The Lowest Property Taxes

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)